10 Stories and Reasons Why You Need Travel Insurance

Do you “really” need travel insurance? Ask anyone who has had to use it and they emphatically say ‘yes’!

One of the big ravel planning tips we give is to assess whether you need to purchase travel insurance for any upcoming trip.

The decision to buy travel insurance is based on 2 factors: financial risk and medical concerns.

- Are you concerned about losing money due to canceled trips, interrupted trips, lost bags, delayed trips, or medical expenses?

- Are you leaving your home country where your insurance from home won’t cover you for accidents?

Do your research to understand travel insurance and the many coverage options.

Also research the various travel insurance companies to find the one that meets your needs best. We recommend and use RoamRight.

We asked 10 seasoned travelers why they purchase travel insurance. Reading their stories can help you understand the situations that may arise as you travel and how insurance can help.

This site contains affiliate links which means WE may receive commissions for purchases made through these links. We only provide links to products we actually use and/or wholeheartedly recommend! As an Amazon Associate, we earn from qualifying purchases. Read the full Disclosure Policy.

10 Stories and Reasons Why You Need Travel Insurance

We think it’s helpful to hear stories from travelers about their need for travel insurance to help you make your decision.

When a Trip Goes Wrong

One morning in East Timor, I reached down to my ankle and felt that it was hot and swollen. Thinking I must have rolled or sprained it, I ignored it and kept travelling.

The next day, I woke up to my ankle being twice the size and bright red. The infection surrounded a scratched mosquito bite. I sent a picture to my doctor at home who told me that I had an extreme infection with cellulitis. I’d already been taking antibiotics as a malaria preventative, so this infection was resistant. My doctor prescribed an antibiotic that I fortunately found at a run-down hospital with blood-stained beds.

I also sent a picture to my travel insurance company. They called me back immediately and told me to prepare to fly out of East Timor if it didn’t get better within twelve hours. I rode on the back of a motorbike across the country with a swollen ankle to get back to the capital in case I needed to catch the emergency flight. Fortunately, the medication I found in East Timor seemed to work – though the doctor said I was likely hours away from sepsis, a deadly blood infection.

My travel insurance company continued to follow up on my recovery each morning. My trip didn’t go as planned, but the peace of mind knowing that my insurance would help me during an emergency was hands-down worth the money.

Clumsy Travels

My friends and family have always described me as clumsy, and well I can’t blame them. I am covered in scars! Well, I prefer to call them my battle scars, especially the ones that are related to a good story.

But after years and years of experience of being a clumsy person I just simply knew I could not ever leave on a trip without getting travel insurance. And I could have not been more right.

On the first 6 months of my current trip I:

- visited a doctor in Singapore for an infection on my hand

- had to go to the emergency room in Taiwan since I had not been able to eat or drink for 4 days

- was involved in a minor motorbike accident while living in Vietnam which resulted in 3 stitches in my thumb.

The total amount spent (including follow up medication): €340,64.

Luckily enough all these costs were covered, and these are only minor incidents. But knowing I have travel insurance to cover emergency health care, makes my travels around the world as a clumsy person a whole lot more enjoyable!

The picture above is of me in Taipei after having been sick for 10 days. I had lost 5kg and finally was able to go outside (but only for one hour!)

When the Unexpected Happens

I’ve never been the type of person to buy travel insurance. But on my latest trip to Ireland for a conference, my mother purchased full insurance on my behalf through American Express the day before I left. I shrugged it off, thinking $200 was an awful lot to spend on top of an already expensive trip.

And then, on my last day in Ireland, the unexpected happened.

A full blown hurricane tore through the country. The entire country was put on red-alert, public transportation was shut down for two days, and a quarter of a million homes lost power. Because I was flying home to a less popular destination, I ended up having to wait for an entire week before my airline could get me on the next flight home.

Luckily, my insurance covered the entire thing – hotels, food, taxi fare, and re-booking connecting transit home. They even reimbursed my little outing to Oslo during my 8 hour layover. If there’s one thing I learned on this trip, it’s that there are some emergencies you truly can’t control, and having insurance makes enduring them a lot less stressful!

Meghan from Meghan The Traveling Teacher

Budget Traveler in Machu Picchu

I am a budget traveler and care about how I am spending money on my trips. I’ve decided that travel insurance is definitely something worth spending money on!

While I was trekking to Machu Picchu in Peru on a four day backpacking trip, I ran out of bug spray. This turned into me getting about a million bug bites on my legs – the pictures are not pretty people!

I had a very bad reaction. The next day as we returned from Machu Picchu on the train, I was unable to stand up – my legs had swollen and I was unable to walk from the bites and pain. My friends and I began calling different hospitals and clinics. Thankfully, my friend who is a nurse was with us and antibiotics are available over the counter. If my friend had not been there who had medical training, I would have had to go to a hospital.

On the same trip a friend was bitten by a dog on the street and did have to spend thousands to receive treatment. Neither of us had insurance and we got really close to having to spend all our money on our medical needs instead of enjoying our travels.

Ever since those experiences last summer, I have purchased travel insurance for every trip I have gone on since. I suggest you do the same! I didn’t think I would ever need travel insurance, but now that it has happened to my friend, I never want to be unprepared again. The small investment upfront is worth saving the worry and stress if, and when something does come up.

Life Happened and Disrupted My Travel Plans

Look, when I was young I thought that foregoing travel insurance was an amazing way to save money. But as I got older, life seemed to happen over and I over again and it sometimes even disrupted my travel plans. That’s when I realized that my brilliant way of saving money was not so brilliant.

This mildly insightful epiphany came after a failed trip to Rome. It was about a week before my mom and I were due to set of on the trip of a lifetime. We were both super excited since neither of us had been there before, but then I got this searing back pain and insanely high fever. I could barely walk and knew that something was seriously wrong.

Well, once I made an impromptu visit to the ER, I found out that I was totally right. I had a Kidney infection that had turned into a blood infection. We kept hoping against hope that I would make it out of the hospital in time for our trip, but it didn’t happen.

If we had purchased travel insurance then we could have at least gotten some of the money back from our trip so that we could plan another vacation. However, that’s not what we did.

We skipped the travel insurance so we could save a hundred dollars, but that mistake ended up costing us thousands. That’s why since then, I always get travel insurance.

Unexpected Accidents Happen To Everyone

I have never traveled without a travel insurance. Every time I meet someone who does, I become that annoying person telling them why they should get insurance as fast as they can. I have used my insurance many times on my travels and am always grateful I have it. The investment came back over a hundred times for me, after all!

I have had to visit a doctor with several minor problems abroad. I also got into serious trouble, like that time I contracted a nasty case of dengue fever combined with a kidney inflammation in Cambodia when my insurance company shelled out over 3000$ for the hospital fee.

This year was a lucky one. I have survived a car crash in which I flew out of the car and broke my spine in April. While the initial hospitalization was free of charge thanks to Turkish laws on emergency treatments, I got assistance and coverage from the travel insurance for the following checkups.

If you still think this kind of thing only happens to the other people. think twice. You never know what difficulties you might encounter on the road and it helps a lot to know that at least you don’t have to worry about a bill at the end of it.

Even If It’s Just a Short Trip

In my second job out of University I was responsible for marketing several different insurance brands. Not only did I quickly learn the key benefits of taking out travel insurance, but I knew the policies back to back and regularly heard absolute horror stories from customers who would have been in a world of debt, pain and inconvenience had they not been insured.

Because of this I am a massive advocate of buying travel insurance and always take it out when I travel, no matter the length of the trip or distance I am travelling from home – even if it’s just a short trip.

I was incredibly lucky that I never had to make a claim until this year. In July I was travelling from Barcelona to Luxembourg with my best friend when security staff were striking at Barcelona Airport. While our luggage was checked in, we didn’t make it through the hour-long security queue in time to board our flight.

I had to make two claims following this event. The first because my suitcase took the flight to Luxembourg and got lost for four days so I had to buy the necessary clothes and toiletries. The second claim was due to the unexpected travel costs of taking trains through France for several days to reach Luxembourg.

The combined costs of the two claims was around $500 US and I was so grateful I had travel insurance who reimbursed me quickly and easily.

I can picture how costs of insurance claims can easily run into the thousands, for example when there is a health related emergency. My experience has only reinforced my belief in always purchasing travel insurance.

That Time I Got Hospitalized in Abu Dhabi

On my way back from Zanzibar I spent one night in a hospital in the UAE. Halfway through my flight from Tanzania to Abu Dhabi an annoying pain I had felt in my side the whole day turned into the most unbearable pain I had ever experienced. Fast forward to 10 hours later: a CT Scan performed at an Abu Dhabi hospital informs me that it was a kidney stone.

What was to only be a 6-hour layover in Abu Dhabi turned into a 2-day stay, including a night at the hospital, treatments and medicines. When the airport medics informed me they were going to call an ambulance and hand me over to the hospital, my first thought was: Just do whatever to fix me. The second was: Wait, how much is this going to cost me?

Luckily, the trip had been purchased with insurance. We had to pay the hospital bill on the spot, but I was later able to claim my money back through the insurance company. Suffering a kidney stone while travelling was quite horrible, but luckily through insurance the treatments I received ended up costing me nothing.

When wondering if it’s worth spending that extra money for insurance, I will always yes. You never know.

The Lost Passport

A few months ago I was not feeling well, but I had promised a friend I would meet him in Phuket. I ordered an Uber to the airport. In my daze of feeling unwell, I didn’t notice that I left my phone in the uber. Luckily my driver handed it into the information centre and I was reunited with my phone.

My stupidity didn’t end there though since I then left my passport in the seat pocket on the plane. I only realized after I was already halfway to my friend’s hotel. After 24 hours I was reunited with my passport again.

Frantic phone calls to my travel insurance company, reassured me that if I did not get the passport back, the costs would have been covered. Ironically my insurance was going to expire that exact same day and to cut costs I had decided not to renew. I quickly changed my mind and extended my travel insurance.

My Bag Went Missing

As a rule I have always used travel insurance. My parents instilled in me that it was a travel essential.

In recent years my partner and I have been taking part in Working Holidays – spending a year in Canada, and then New Zealand. For Working Holiday visas getting insurance is a requirement of the visa. When you reach the border, the officer issuing your visa may ask for your health insurance documentation, and if you don’t have it (and the right kind) you can be denied entry. You also need to make sure that it’s the correct type: it needs to cover medical care, hospitalization, and in the event of serious injury/illness or death, repatriation so you can get back to your home country.

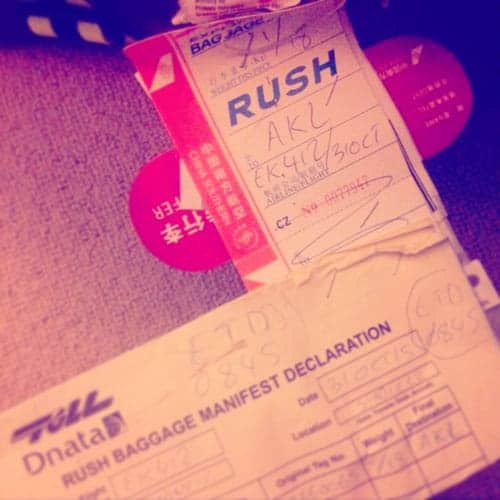

I haven’t ever used it myself – in New Zealand my bag went missing for 4 days after it went on a jaunt to Australia without me, and I could have claimed on my insurance for that. After the stress of living out of my boyfriend’s clothes for 4 days I couldn’t be bothered with the extra hassle of doing all the paperwork! But I’d still always buy it. Just in case!

When Travel Insurance Is NOT Needed

It’s important to evaluate the need for travel insurance. You don’t want to waste money or be over-insured!

There are 3 instances when travel insurance is NOT necessary:

Last-minute domestic trips

- Since you have not pre-paid any non-refundable trip costs, you are not concerned with trip cancellation or interruption coverage.

- Since you are within the U.S., your health insurance plan will cover you for any emergency medical situations.

- Buying travel insurance would give you coverage for lost baggage and travel delays, but these coverages alone might not be worth the cost of a plan.

Cheap domestic trips

- When you get a super deal on your flight and you’re staying with family members, you don’t have much money at risk.

- Travel insurance is best used when your pre-paid and non-refundable expenses are more than you are willing to lose.

- Again, you are missing out on coverage for baggage and delays, but these coverages alone might not be worth it.

If you can afford to lose your pre-paid trip expenses

- If you can afford to lose the money, skip the insurance.

Travel insurance is best used when your pre-paid and non-refundable expenses are more than you are willing to lose. If you only have a few hundred dollars at risk, you can afford to ‘self-insure’ this risk.

I absolutely agree with you! Travel insurance should never be ignored at all, and I always travel with one. OMG, those stories are never wrecking. This is a wonderful post, I am sure this is helping a lot of people right now.

We hope it’s helping people to make educated decisions about travel insurance. Thanks!

Wow, this story with Chantae’s ankle sounds scary! It must have been really shocking, fortunately she was covered by a good insurance. I have had a bad stomach flu in Spain once and was also really happy about my travel insurance. Hearing all these different stories should be a reminder for everyone.

Yes, so many stories about the need for insurance when travelling. Sorry to hear about your bad stomach flu. It is no fun to be sick when away from home!

I think it’s s great post and very helpful to any traveller. I work for insurance a d understand the importance. Well presented and very helpful. Thanks for sharing this.

Thank you – travel insurance is too often overlooked. We hope to educate people so they can make an informed decision.

I absolutely agree with this post. Travel Insurance is very important and the examples and personal experiences that you have shared are totally convincing.

Travel is unpredictable and health is very important. Medical emergency can occur anytime. Thus travel insurance is a must.

I completely agree and cannot stress enough to people about getting travel insurance when they travel. Not only is it not very expensive, its so worth the peace of mind you can have. Imagine if you were to, lets say, fall sick, do you know how expensive medicines and treatment can be in certain countries? Why take that risk, instead of spending a few bucks and being at peace?

Yes, the cost of medical care in another country is a definite unknown and not worth the risk.

I 100% agree with you – Travel insurance is a must! Life is so unexpected that paying for insurance is worth it when an emergency occurs out of the sudden. great post! Thank you for sharing. – Ella

Thank you, Ella. Life is unexpected, and I’d rather have peace of mind when that unexpected happens!

I actually never purchase travel insurance. I understand that unfortunate circumstances happen, but I feel like I’ll luck out more times than not. Reading all these stories certainly has proven that bad luck and misfortune happen, but I’m not sure if it’s quite convinced me to purchase travel insurance. To me, I still see it as an unnecessary expenditure, though it could save me in a pinch, I rather risk it without it. Interesting read, though!

I appreciate your comment explaining why someone would not get insurance. I hope you always have safe travels!!

Very informative post! We always opt for travel insurance, especially when travelling internationally. I can relate to these stories as I’ve experienced it myself. I was hospitalised for seafood allergy on my trip to Mauritius. Thankfully we were insured.

International travel requires insurance in my opinion. I’m sorry you were hospitalized on your trip, that’s no fun. But I’m glad you were insured!

I completely agree! World Nomads is a great insurance and it got me covered during most of my year in Europe. Just when my coverage ended a few days before my return I got a back injury. I was able to fix it on my own, but it would have been so much better if I could just have gone to the hospital.

Oh no, a back injury is no fun. I’m glad things ended well for you. And yes, we have only had great experiences with World Nomads.

I agree, travel insurance is very important to have! Luckily for us, our medical benefits already include a good travel insurance. Another thing to be thankful for, we haven’t needed it so far. The experiences shared by these travelers show how much travel insurance is needed!

I feel so good after reading this, as I always buy travel insurance! Thankfully, nothing yet (touch wood) has happened while travelling, but you just never know! Very scary about that hurricane story; I can’t imagine what I’d do!

Most companies are really good at helping you through the experience. And yes, I’ll knock on wood for you that nothing happens either 🙂

Wow so many stories with travel accidents! some are more worse than the other but thankfully everything turn our fine! I think is simply dumb not having an insurance while traveling! Thats when you risk more having an accident, infection etc! We live in Switzerland and its obligation to have an assurance if you want to live here so its something totally normal for me. But this post is awesome for reminding people why an insurance is important! Even for minor incident!

Oh I would never leave my country without an insurance :O

Thank you for putting such an informative post together about travel insurance! It’s something I’ve been contemplating and unsure about for awhile now and I really understand the merits of having it now!

I really use the guideline of ‘can I afford to lose the money for x’ if something goes wrong if I travel within the US. If I travel abroad, I ALWAYS get it!

Such an important post! I’ve always gotten travel insurance and haven’t needed to use it before… But the peace of mind is so worth it! I’m too clumsy to risk it 😉

Peace of mind is worth so much!

These stories are horrifying! I am so glad these ladies got the help they needed. I never travel without insurance when outside Ontario. Even when I went to Mackinac Island Michigan for ONE DAY I bought insurance for that one day as you just never know. Great post.

It’s so true, you just never know!